Cpp 2025 Maximum. For 2025, the maximum pensionable earnings under the canada pension plan (cpp), for employee and employer is 5.95% (2025: For 2025, the maximum cpp benefit is $1,364.60 per month, with the average benefit for new retirees at $758.32 per month.

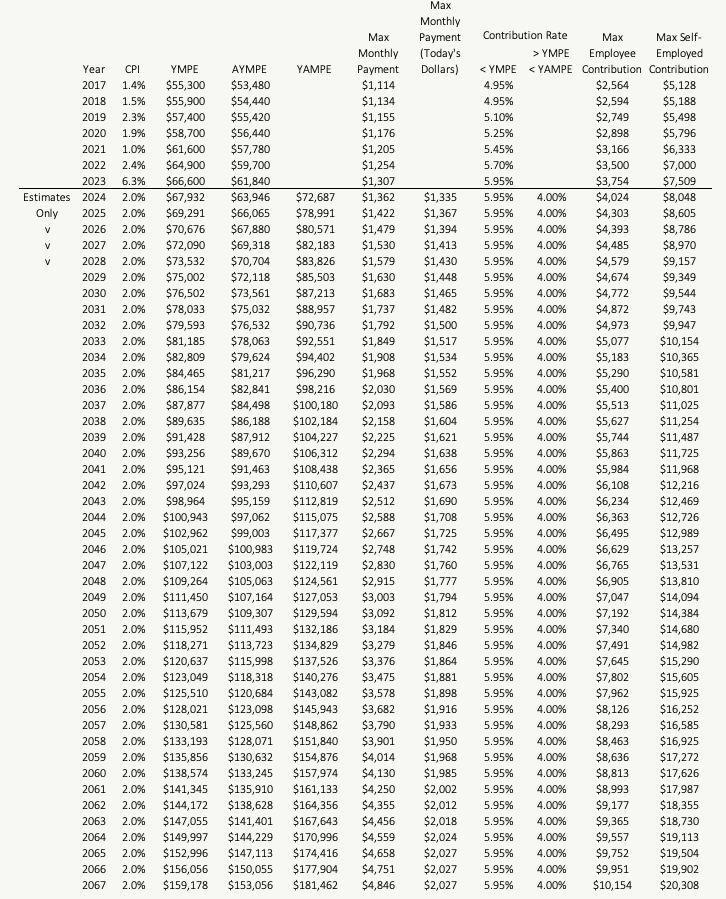

Employer and employee cpp contribution rates for 2025 will remain at 5.95%, and the maximum contribution will be $3,867.50 each, up from $3,754.45 in. For 2025, that means a maximum $188 in additional payroll deductions.

For example, someone who consistently earned the old 2025 ympe of $64,900 would get a maximum cpp benefit around $1,253 monthly starting at 65.

CPP Maximum Pensionable Earnings Increased to 68,500 in Year 2025, Eligibility for the maximum cpp benefit requires. For 2025, the maximum cpp benefit is $1,364.60 per month, with the average benefit for new retirees at $758.32 per month.

Maximum OAS Increase 2025 Anticipated CPP & OAS Rise Jan to Mar, For 2025, the maximum cpp benefit is $1,364.60 per month, with the average benefit for new retirees at $758.32 per month. What is the maximum cpp benefit i can receive in 2025?

Retirees What’s the Maximum CPP Benefit in 2025, Employer and employee cpp contribution rates for 2025 will remain at 5.95%, and the maximum contribution will be $3,867.50 each, up from $3,754.45 in. For 2025, the maximum cpp benefit is $1,364.60 per month, with the average benefit for new retirees at $758.32 per month.

CPP Max 2025 Understanding Canada Pension Plan Contribution Rates, For example, someone who consistently earned the old 2025 ympe of $64,900 would get a maximum cpp benefit around $1,253 monthly starting at 65. For 2025, the maximum cpp benefit is $1,364.60 per month, with the average benefit for new retirees at $758.32 per month.

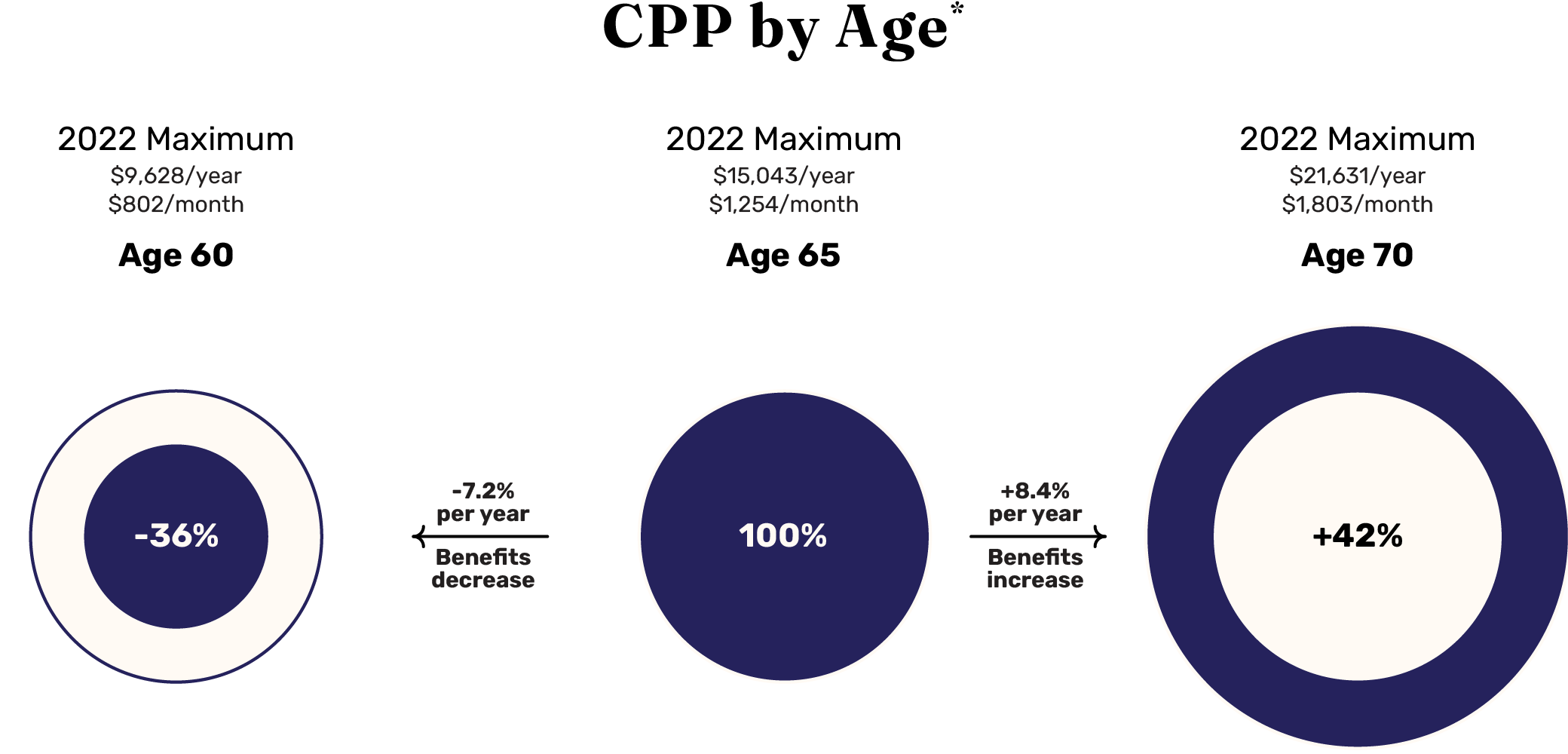

Confirmed CPP Maximum Pensionable Earnings to Reach 68,500 in 2025, The maximum monthly cpp retirement benefit for new recipients starting at age 65 in january 2025 is $1,364.60. Employee and employer cpp contribution rates for 2025 remain at 5.95%, and the maximum.

Maximum CPP Contribution for 2025 A Complete Analysis MyBikeScan, Employee and employer cpp contribution rates for 2025 remain at 5.95%, and the maximum. Employer and employee cpp contribution rates for 2025 will remain at 5.95%, and the maximum contribution will be $3,867.50 each, up from $3,754.45 in.

Significant HSA Contribution Limit Increase for 2025, The maximum monthly cpp retirement benefit for new recipients starting at age 65 in january 2025 is $1,364.60. The maximum cpp contribution for 2025 is $3,942.45 if you are an employee.

The CPP Max Will Be HUGE In The Future PlanEasy, The cpp enhancement will increase the maximum cpp. For example, someone who consistently earned the old 2025 ympe of $64,900 would get a maximum cpp benefit around $1,253 monthly starting at 65.

When Should You Take CPP?, Eligibility for the maximum cpp benefit requires. Cpp payments are made monthly, and the.

How to apply for canada pension from usa Fill out & sign online DocHub, Employee and employer cpp contribution rates for 2025 remain at 5.95%, and the maximum. The maximum cpp benefit is subject to change each year.